A Comprehensive Guide to Management Buyouts

What is a management buyout (“MBO”)?

An MBO is a transaction in which the existing management team of a company buys the shares in a company from its current owners (“Seller(s)”). An MBO typically involves the management team securing third-party finance to assist with the purchase of the company.

MBOs are one of many options available for owner(s) seeking an exit, and we often see them used where the existing owners are retiring or the management team wishes to take control of the business and take it forward. MBOs can also be used in family-owned businesses when passing the business on to the next generation.

What are the steps of an MBO?

The steps required for an MBO are similar to that on a sale to a third-party purchaser. There will be the initial negotiations covering issues such as deal structure, valuation and funding. The hope is that the parties’ knowledge of each other, and the management team’s knowledge of the business, can make the initial negotiations more efficient.

The level of due diligence that the management team requires will depend on the visibility they have over the business. It may be expected that, when compared to a sale to a third-party, the level of due diligence required will be lower; however, there may be areas of the business over which the team does not have full visibility. The legal due diligence typically runs alongside any financial and tax due diligence. It is vital that accountants and third-party financers are on board with due diligence at an early stage, as advisers play a vital role in structuring the MBO in a way which ensures all benefits are maximised and the risks dealt with accordingly.

The legal documents required for a management buyout of shares are often the same as that for a transaction involving a third-party purchaser.

The key document for the sale and purchase of the shares will be the share purchase agreement (“SPA”).

The SPA will set out the commercial terms of the transaction, such as who is selling what, to whom, and for how much. The SPA would also contain contractual protections for the management team by way of warranties and (potentially) indemnities. Warranties are contractual promises as to the state and affairs of the business. Indemnities may be sought by the management team for any areas identified during the due diligence process as high risk.

Another key negotiation point in the SPA is likely to be the restrictive covenants. The purpose of restrictive covenants is to prevent the Seller(s) from competing with the business of the company for a period of time following completion.

Lenders may also require the company and/or the management team’s purchase vehicle (for example, a holding company) to provide security for the monies lent. The security may include fixed and floating charges over the company’s assets, or a personal guarantee from the individual management team shareholders. The lender should provide their requirements for security at an early stage.

How will the MBO be structured?

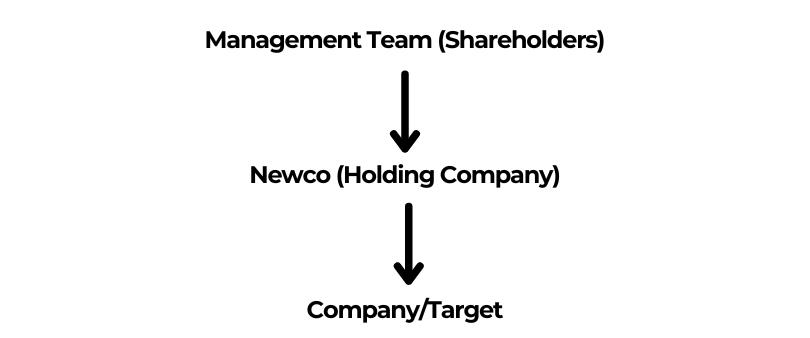

One of the most common, and simplest, structures for an MBO is for a new company (“Newco”) to purchase the shares of the company from the Seller(s). The Newco will be owned by the management team. The structure in this instance would be as follows:

The structure of an MBO will depend on the type of third-party finance the management team secures to help with the purchase. Lenders may have certain requirements and, as mentioned earlier, it is vital that they are involved as early as possible in the process.

What are the potential benefits of an MBO?

- Selling a business can be a time-consuming process, from the initial negotiations through to the transitional period following the sale. The hope is that the parties’ familiarity with each other will be reflected in a more efficient and cost-friendly negotiation process.

- An MBO provides the potential to structure the transaction in a way that helps the management team with the business’s future cash-flow. It is likely that the team have had to secure a large amount of third-party finance for their purchase, and so deferring the payment of part of the consideration can be advantageous to the team. This allows them to focus on maintaining and improving the business without the pressure of paying a significant lump-sum to the Seller(s).

- The Seller(s) have the benefit of knowing that the business they built is being passed on to a team which they had put together and trust. This is even more important if the Seller(s) stay on as a minority shareholder(s) and will continue to benefit from the company’s success.

- For the management team, an MBO is likely to be the easiest and lowest-risk way of becoming an owner of a business. The team will have control of the business, and, as shareholders, will have a right to vote on key matters relating to the business. The team will also benefit financially (by way of dividends) from any future growth of the business.

- An MBO will hopefully provide a smoother transition for customers, clients and employees than a third-party sale. The team that these parties deal with on a day-to-day basis will not change. Often with a sale to a third party, especially to a larger group, there is the potential for uncertainty as a change of ownership may result in significant changes to the way a business operates.

How can Rollits help?

Rollits are able to assist with preparing and/or reviewing the legal documents required, including:

- Heads of Terms;

- Confidentiality agreements;

- Shareholder agreements;

- Articles of association;

- Share sale and purchase agreements;

- Employment documents such as Settlement Agreements, Director Service Agreements etc.;

- Banking and security documentation; and

- Ancillaries, such as board minutes, Companies House returns etc..

If you are considering a MBO as a suitable exit or purchase strategy and wish to discuss please call us in Hull on 01482 323239 or in York on 01904 625790. Alternatively, you can fill in our contact form and one of our lawyers will get back to you.